Top Ways to Prevent Fraud in Magento 2 by Restricting Risky Payment Methods

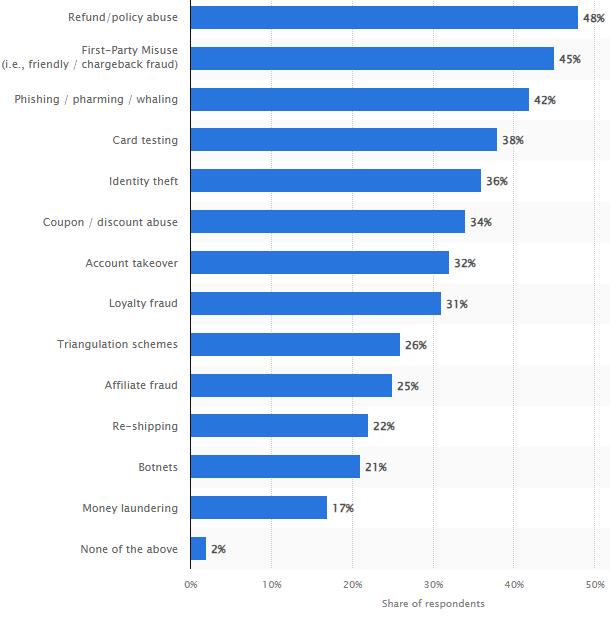

Despite advancements in technology and strengthening of eCommerce laws worldwide, fraud remains very much a concern for every store owner. The below statistic shows most common fraud experienced by online store owners worldwide.

Regardless of the nature of fraud, we know that it undermines the store’s profitability. Depending on the severity and frequency, the store may have to shut down permanently. Apart from the profitability, preventing fraud is critical to preserving a brand’s reputation or ensuring customer trust.

There are different ways to prevent fraud in Magento 2. One method is to hire a specialist fraud prevention company. This company will undertake a comprehensive risk assessment of your store and then provide detailed recommendations. However, this approach is mostly feasible for large multinational stores only.

After all, small to medium online stores do not make enough to hire a specialist company. Even if they do, this approach is not always cost-effective. There are other practical ways to prevent fraud such as restricting risky payment methods. As the above statistic indicates, most of the fraud is related to payment methods.

Therefore, it can be said that by carefully managing the payment methods in Magento 2, store owners can prevent fraud to a greater extent. This can enhance profitability and the user experience. In this article, our focus will be on how restricting risky payment methods in Magento 2 can prove beneficial.

Types of Payment Frauds

You need to understand that payment fraud can take various forms, including:

- Identity Theft

A criminal may assume an identity of another person and create fake accounts in their name. They complete transactions using the fake identity.

- Credit Card Fraud

Criminals may gain unauthorised access to an individual’s credit card. They use it to buy items from a store. Once the original cardholder gets information about these unauthorised transactions, the request a chargeback. As a merchant, there’s very little you can do to prevent the chargeback. Not only do you have to refund the payment, but the item may have been shipped already.

- Chargeback

Even legitimate customers request chargeback. Their motive is to get the amount refunded despite getting the item. They usually claim that they did not authorise the payment or never received the item.

- Coupon/Discount Code Abuse

Merchants often give out coupons and discount codes as a way of building brand loyalty. Unfortunately, users tend to abuse this sales strategy. What they do is create multiple accounts and then use the same coupon/discount code. Apart from this, users may gain access to stolen codes/coupons.

- Refund Abuse

There are numerous cases where users request a chargeback after having the item delivered. Instead of delivering the original product, they often ship a counterfeit product or empty package.

Preventing Fraud by Restricting Risky Payment Methods in Magento 2

Certain payment methods are riskier than others. For example, when customers use a credit card, they can often request a chargeback. The payment gateway usually holds the payment for a certain period before being released to the merchant. Thus, processing a chargeback is usually hassle-free.

The merchant has no control over the money. On top of it, it is likely that the item has already been delivered. In the case of wire transfer, chargeback is not possible since the amount has already been transferred to the merchant’s account. The downside is that not everyone can afford to buy your products upfront.

Thus, they have no option but to use credit cards. In case you have restricted them, they cannot complete the transaction. In other words, your sales will decline. Similarly, cash on delivery is a great way to avoid digital frauds and ideal for users who are reluctant to enter their banking information online.

However, there’s a risk that the money be stolen or mishandled. For instance, in high crime areas, carrying cash is not a wise decision. Therefore, it can be concluded even though certain payment methods are high risk, there’s no choice but to keep offering them despite potential for abuse.

The question is, is there no way to balance fraud prevention and payment methods preferred by customers?

Restrict Risky Payment Methods Using Payment Restrictions Magento 2 Extension

Wouldn’t it be great to:- Allow credit cards to customers who have no history of chargebacks?

- Offer cash on delivery to certain areas, while blocking it in high crime areas?

- Restrict the use of digital wallets based on the individual’s risk score?

- Set purchase limits for new or unverified accounts?

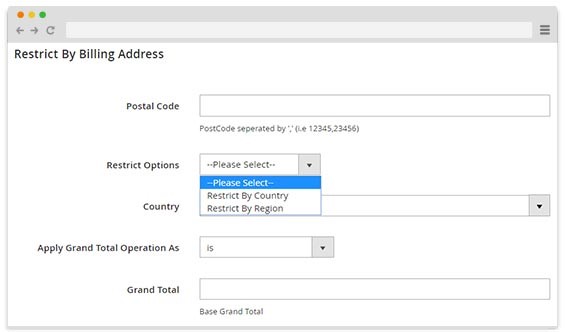

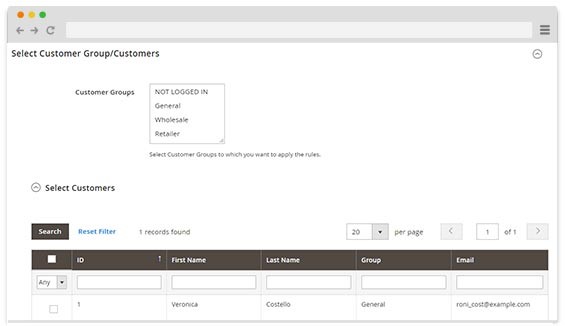

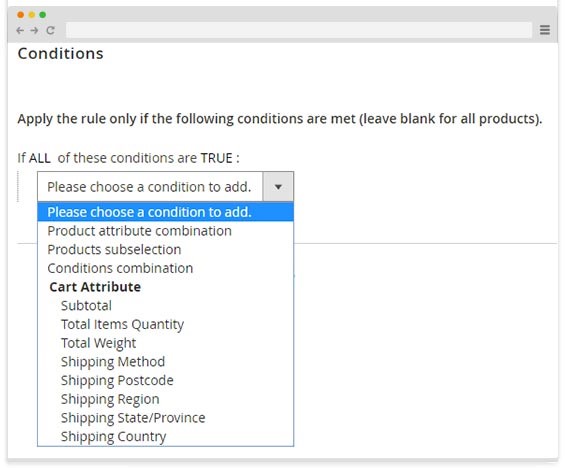

Well, all of this can and a lot more can be done using the Payment Restrictions Magento 2 Extension by FME. The below image provides an overview of what this extension has to offer:

Let’s apply the restrictions to a few use cases to understand how it can prevent fraud:

- Restrict Payments Based on Location

- Individual User Restrictions

- Customer Groups

- Cart Attributes

Thus, allowing such individuals to buy items on your store using a credit card is not an ideal approach. They can request a chargeback despite you having fulfilled the order. In such a case, the ideal scenario is requesting direct bank transfer (wire transfer) or cash on delivery. In the latter case, the item is handed to the customer and money is paid simultaneously.

Suppose you have a customer A. He is a frequent buyer at your store. At the same time, he has a reputation for requesting chargebacks. For instance, for every 3 items bought, the customer requests a chargeback for 2 items. As a store owner, it is better to prevent customer A from shopping using a credit card. They can opt for other payment methods that are not as convenient when it comes to chargebacks.

The Payment Restrictions Magento 2 Extension by FME allows merchants to implement restrictions based on customer groups. As mentioned earlier, identity fraud is a concern for every store owner. To avoid such frauds, you can use the extension to set restrictions for new, unverified, or guest accounts. You can restrict them to a specific payment method such as direct bank transfer.

If you wish to offer them credit card facility, you can set a limit on the maximum order value. Certain payment methods are ideal only for a select few customer groups. For instance, there’s no point in offering pay order payment method to individual customers since they are mostly used in B2B transactions. In other words, you can restrict this method to only wholesalers or retailers.

Certain products are more susceptible to payment frauds than others. For instance, electronic items or clothing can easily be resold to others without much hassle. Using the extension, you can set payment restrictions based on cart attributes such as item, item category, order value, and more.

Final Thoughts on Payment Restrictions in Magento 2

This concludes our article on the top ways to prevent fraud in Magento 2 by using a Payment Restrictions Magento 2 Extension. When configured correctly, you can improve your store’s profitability without any negative impact on the user experience. If you require help, reach out to our support team.

This blog was created with FME's SEO-friendly blog